At the November 2025 polls, Liberty Hill ISD residents approved Prop A, a Voter Approved Tax Ratification Election (VATRE) of $1.24. This was an increase of $0.07 pennies from the previous year. This approved election will increase this year's school revenue by $10.7 Million to the Maintenance & Operations budget and will support additional funding for future school years.

Thank you to all voters who came out to cast your ballot during the election cycle.

We understand this election was difficult for many as a tax increase carries a financial burden on some households. Liberty Hill ISD is committed to demonstrating transparency and building trust through the process of investing these funds back into our students and staff.

We created this page to keep you all informed as the funds from Prop A are put into action.

$7.2 Million to Student Programs

$1.3 Million for Safety and Security

$2.2 Million to Recruit and Retain High Quality Staff

When will Liberty Hill ISD receive the $10.7 million to begin reinvesting back into student programs, school safety and staff retention and recruitment?

LHISD will begin receiving the funds as local residents and business pay their annual county tax bills over the next couple of months with a majority of the funds being received by February 2026. Additionally, the Texas Education Agency (TEA) will make state payments to LHISD in March 2026.

In what account and how will the $10.7 million be allocated?

Prop A funds will go towards the Maintenance and Operations (M&O) budget. This budget goes towards staff salaries and benefits, utility costs, insurance, supplies and other day to day expenses. 86% of the M&O budget is allocated to staff salaries and benefits.

Prop A funds are not primarily used to build new buildings, construct athletic facilities, purchase land or complete major maintenance. In 2021 and 2023, Liberty Hill ISD voters approved bond elections that dedicated funds to those capital projects and improvements. To see Bond updates, click here.

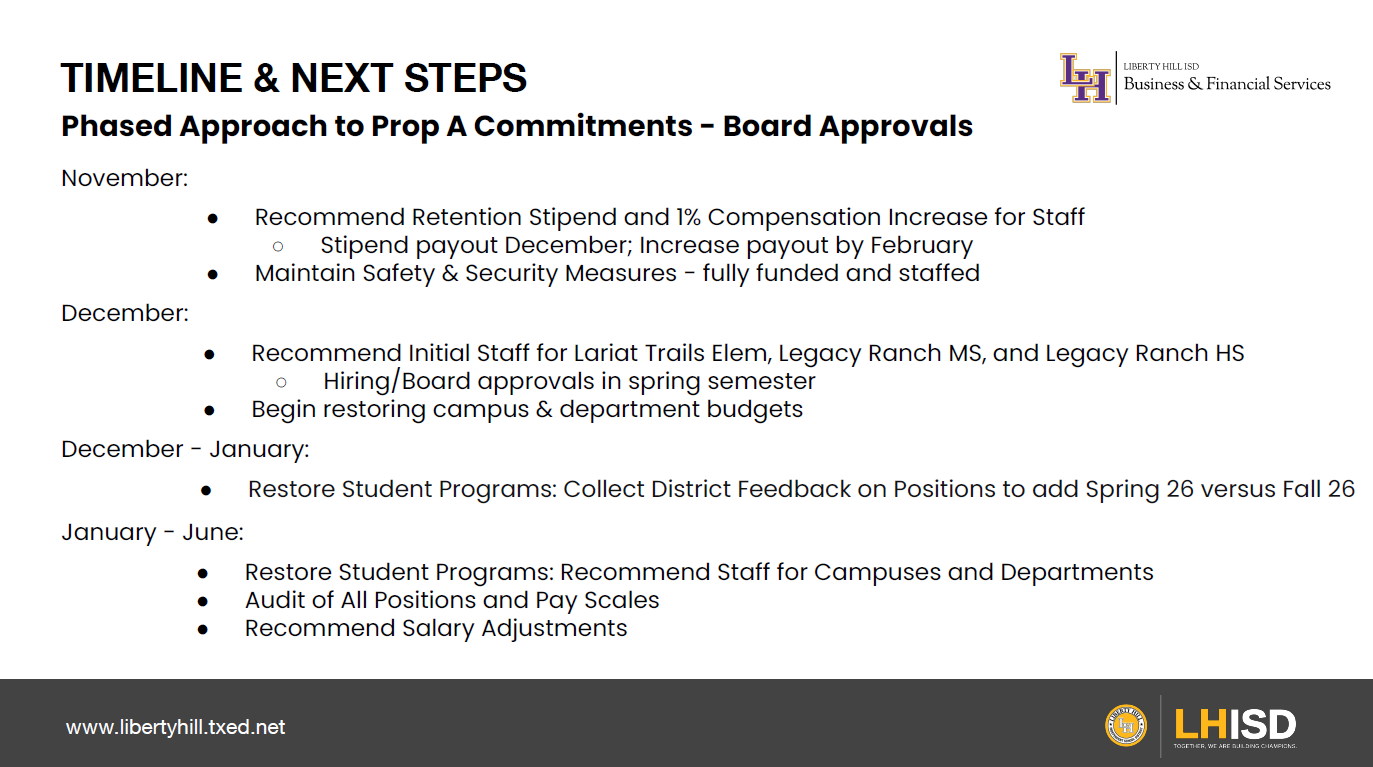

Timeline

The following timeline was presented to the school board by CFO Rosanna Guerrero on Monday, Nov. 17, and outlines how Prop A will be put into action over the next eight months.

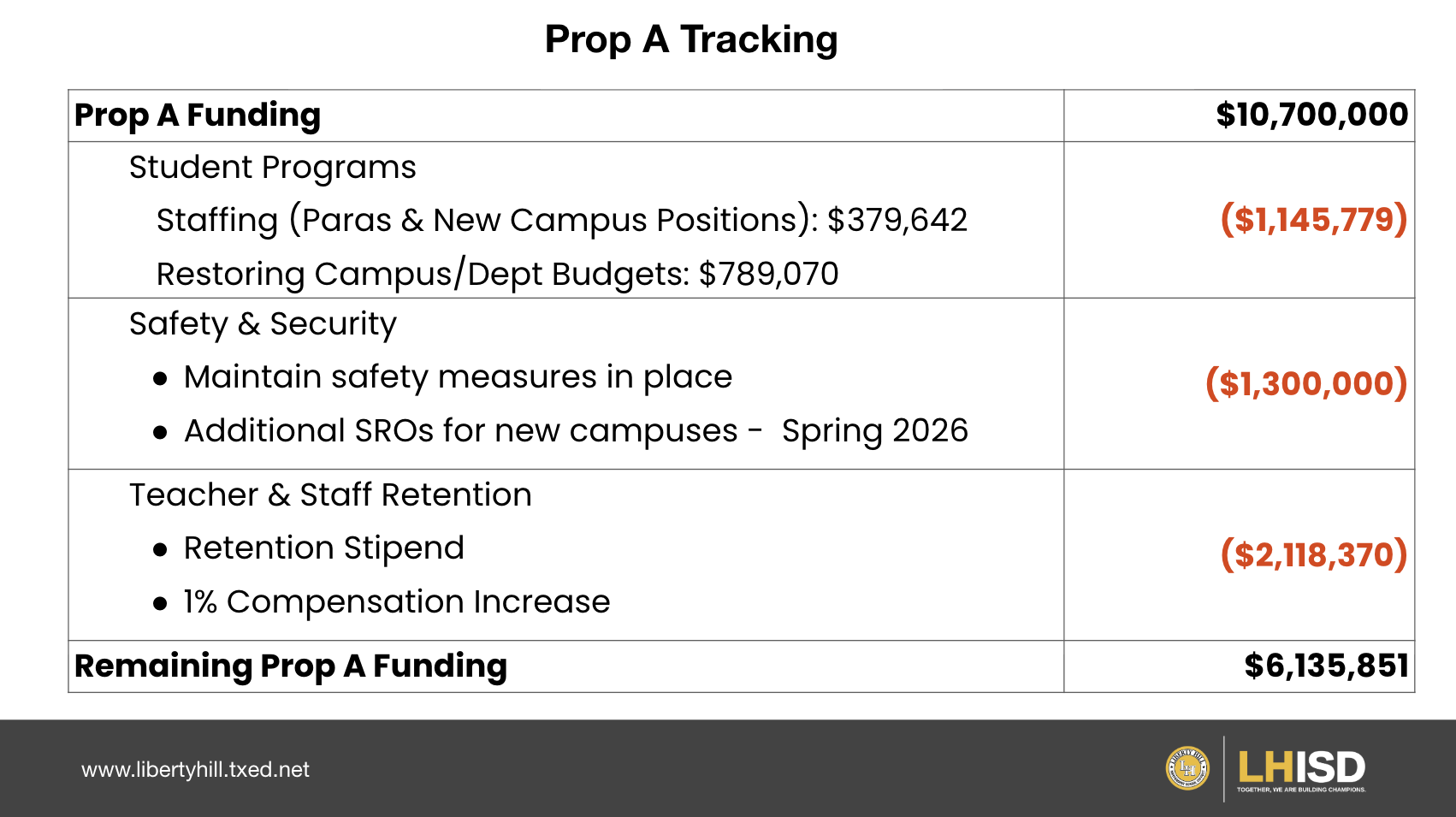

Tracking

As the funds from Prop A are received and put into action, we will provide updates here. The numbers in red indicate action has been taken, and those dollars have been allocated or spent.

Student Programs - $7.2 Million

The passage of Prop A allows LHISD to restore student programs, staff positions, and campus budgets that were cut last school year. Some of these programs and positions included Gifted & Talented programs, Behavioral Specialists, librarians, STEM, middle school and high school planning periods, and more.

LHISD is currently evaluating the most efficient way to restore the programs and positions to ensure we maximize tax payer dollars and are not in the position to potentially make more cuts in the future.

Campus budgets include but not limited to:

Instructional supplies

Supplies for campus administration, nurses, and counselors

Library books

LHISD is grateful to the campus families, community members, local businesses and PTO members who filled in the gaps in campus budgets to kick off the school year!

Prop A Spending Update:

November 2025: LHISD is currently working with campus principals to determine the positions of critical need for the remainder of the 2025-26 school year. Those positions will be posted online soon. Additional positions will be opened up for staffing for the 2026-2027 school year.

December 2025:

Restoring funds to the per-student allotment that was previously reduced

Adjusting campus budgets in January based on current enrollment and staffing levels

Adding one additional paraprofessional at each campus to address immediate student needs

January 2026: At the school board meeting, trustees and the public will be given another update on the reinvestment of Prop A funds. School board meetings live stream here.

Safety & Security - $1.3 Million

The safety of our students is our highest priority.

With the approval of Prop A, LHISD will be able to continue fully funding campus and department safety and security initiatives which includes an armed police officer at every campus.

Unfortunately, the state of Texas funding for school safety is well below the actual costs. LHISD needs $180 per student to ensure all current safety initiatives are in place but only receives $55 per student. The difference between total costs vs actual funding is $1.3 million. Prop A funds will be used to cover this cost deficit and allow us to keep our safety initiatives in place.

Armed Officers on Campus - $1,570,706*

Effective September 1, 2023, HB3 requires that “at least one armed security officer be present during regular school hours at each district campus. This can include a school district police officer, a school resource officer or a commissioned peace officer. If the board of trustees of a school district is unable to ensure the above, the board may claim a good cause exception from the requirement to comply if the district's non compliance is due to the availability of funding or personnel who qualify to serve as security officer.”

The Liberty Hill ISD board of trustees is committed to keeping an armed police officer at each campus and the funds from Prop A allows the district to keep this commitment.

State allocation for 11 campuses = $369,000

LHISD Cost for 11 campuses = $933,508

LHISD Cost for officer training, supplies, and vehicle maintenance = $85,000

LHISD Cost for department budget, Salaries for Chief, Sergeant, and Administrative Assistant = $552,198

Safety Monitoring Systems- up to $354,553*

Liberty Hill ISD uses other safety monitoring systems inside the district to keep kids safe from unauthorized visitors on campus and online threats. These systems include:

Silent Panic Alert Technology (SPAT), School Safety Software = up to $74,000

SPAT technology allows for immediate alerts from classroom teachers to campus leadership and district personnel in the event of an emergency. School safety software screens visitors on campus to make sure only those approved are allowed inside the school building with access to our students.

Device Monitoring = $24,000

Our device monitoring software alerts designated school staff of certain activity on student devices. This includes: violence, mental health concerns, online bullying, self-harm, suicidal ideation, drugs, gangs, grooming, and more.

Cyber Security Staff and Software = $118,000

For safety purposes, LHISD does not disclose our cybersecurity software or staffing details. In general, this category includes: backups, renewals, storage, and personnel.

Safety & Security Coordinator, Crossing Guards, Parking Lot Attendants = $138,553

LHISD has a full-time safety & security coordinator whose job includes everything from emergency operations and drills and training to management of access control and video surveillance. In addition, we have 8 crossing guards and a parking lot attendant who monitors mid-day student activity at Liberty Hill High School.

* some of these costs are offset but not fully funded by federal grants

Recruit and Retain Staff - $2.2 Million

LHISD is working closely with the Texas Association of School Boards to evaluate all employee pay scales. Recommendations will be made in late Spring of 2026 to the school board as part of our 2026-2027 compensation page.

Recruit High Quality Staff

As Liberty Hill continues to grow, LHISD will be adding teachers and staff to meet the needs of our growing student populations on existing and new campuses.

With a national teacher shortage, competitive pay is important when recruiting high-quality teachers and staff to join LHISD. The 2026-2027 pay scale reflecting the new pay for teachers will be presented to the school board for approval in late Spring of 2026.

The 2025-2026 pay scale for Liberty Hill ISD and surrounding districts is below. These numbers are from the beginning of the 2025-2026 school year and show the need for Prop A.

Sources: Liberty Hill ISD, Georgetown ISD, Leander ISD, Hutto ISD, Burnet ISD

Retain High Quality Staff

I’m so appreciative for the stipend we received, especially before the holidays! It’s always nice to feel seen and to know that the community values staff and the work that we are doing!

Prop A Spending Update:

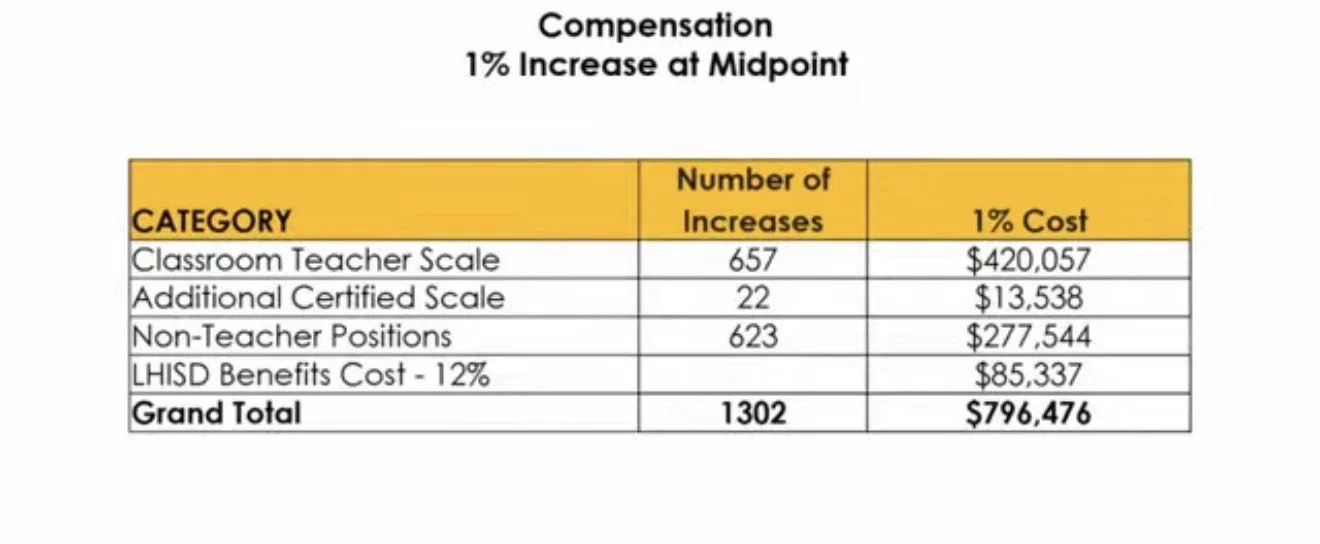

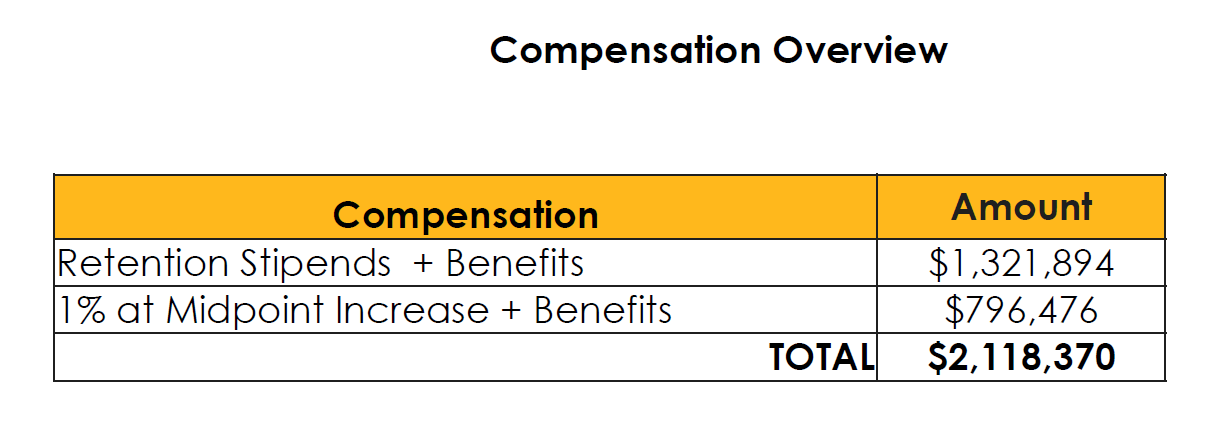

November 17, 2025: LHISD Board of Trustees approved an employee retention stipend of $500, $1000 or $1500 for every LHISD staff member who started before 10/1/25, based upon their tenure with the district and a 1% mid-point pay raise.

December 2025: Retention Stipend - Over $1.3 million in retention stipends were issued to staff, separate from their regular paycheck.

February 2026: Additional 1% mid-point raise - Payroll will issue a 1% mid-point pay raise to all LHISD staff. This will be retroactive to each employee’s first active workday of the 2025–2026 school year, based on their service calendar. The new pay rate will become part of the employee’s compensation package moving forward.

November 2025: Each campus is adding an additional Paraprofessional to address immediate needs. Hiring staff for opening the new campuses (Lariat Trails Elementary, Legacy Ranch Middle School, Legacy Ranch High School).

December 2025:

An additional 1% raise applied to December paychecks, with retroactive settlement in January/February

Hiring staff in preparation for the opening of new campuses

TASB staffing audit is currently underway

Reviewing all options for additional staffing and future compensation increases

Strategic approach to staffing increases to ensure long-term sustainability and protect future raises